easy auto warranty coverage that gets you back on the road

You want protection that turns a breakdown into a brief interruption, not a budget crisis. The right plan backs you with support and pays big bills without drama.

What it should do for you

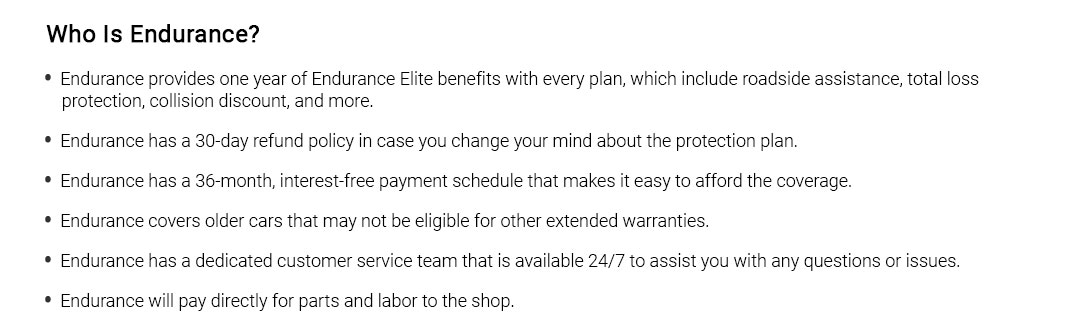

- Pay approved repairs for covered components - parts and labor.

- 24/7 roadside and towing to an approved shop you trust.

- Clear deductibles, no surprise shop fees, fast authorizations.

- Simple claims by app, text, or a human who picks up.

Judge it in five minutes

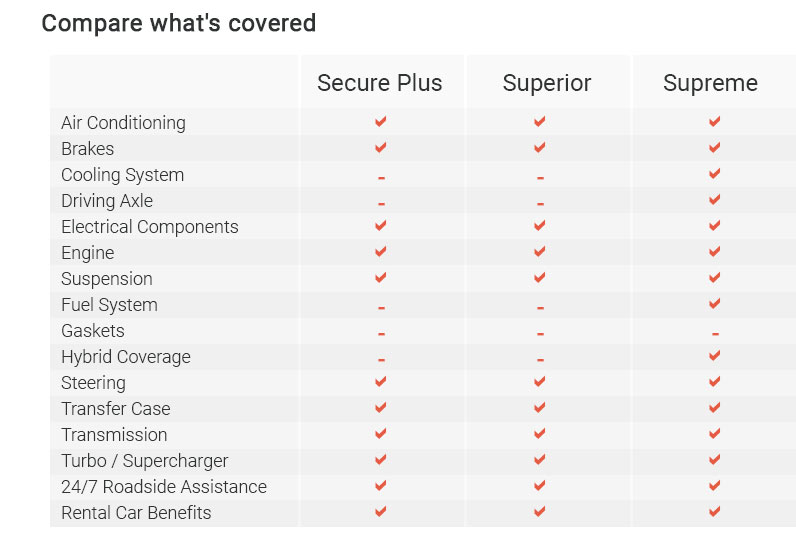

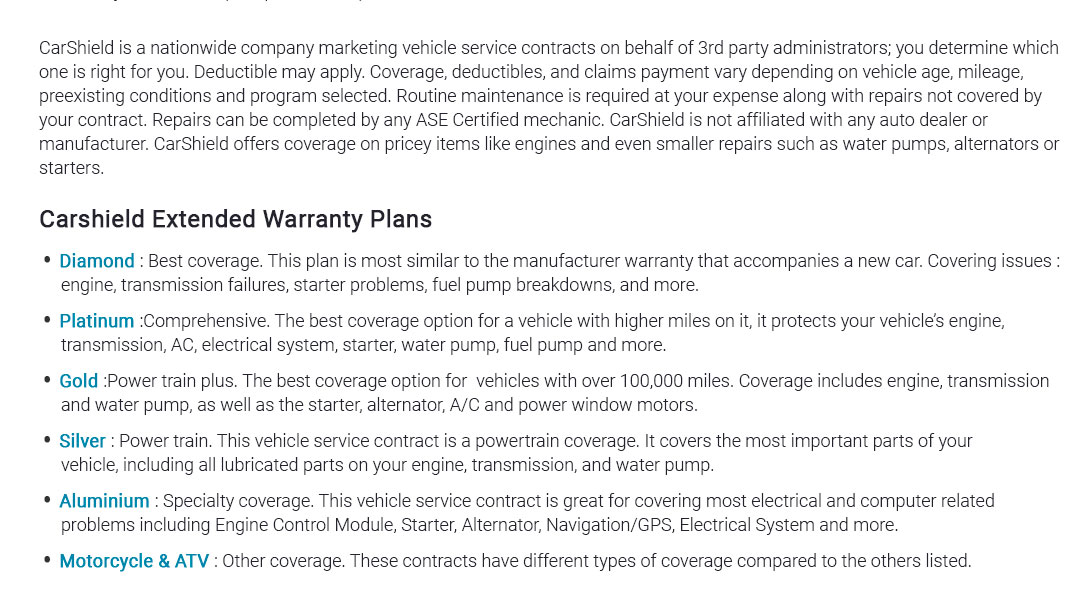

- Match coverage to your risk: powertrain, stated, or exclusionary.

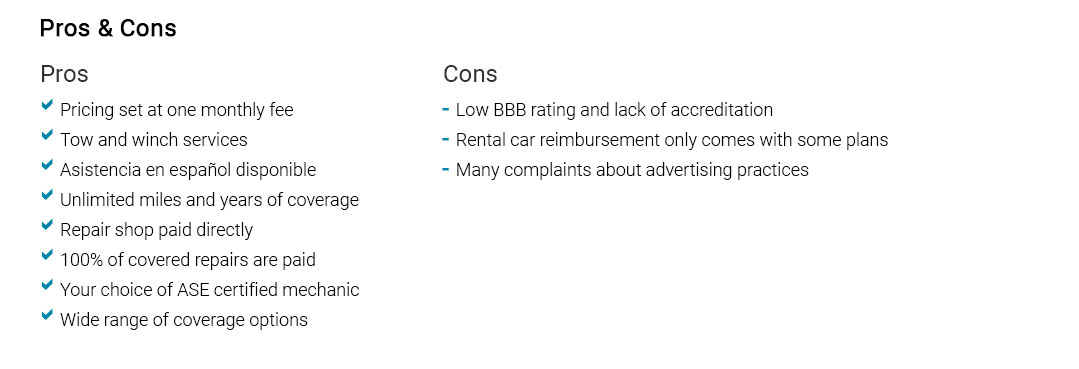

- Check payout caps, deductibles, and labor rate limits.

- Read exclusions: cooling, electronics, diagnostics, wear items.

- Confirm shop network and your right to choose a mechanic.

- Walk the claims flow: who calls and who approves.

Neutral pause: you just need the car to work, reliably.

A quick, real-world moment

Tuesday, rain, flashing check-engine light. You call support; they dispatch a tow, approve an O2 sensor, and set a rental. You pay the $100 deductible, drive away next day, and the invoice never hits your card.

Costs and trade-offs

Balance monthly price versus deductible. Older vehicles may need broader plans. Keep maintenance records; coverage expects proof. Pre-authorization matters - call before the wrench turns.

If you decide to explore

Ask for sample contracts. Compare the same tier. Request claim timelines. Test the support line. Keep digital copies. If it feels simple - and supported - you're on the right track.